To obtain a more informative measure when calculating capital expenditures, users should include what is spent to acquire land, building, and other capital assets-even if obtained via a business combination.

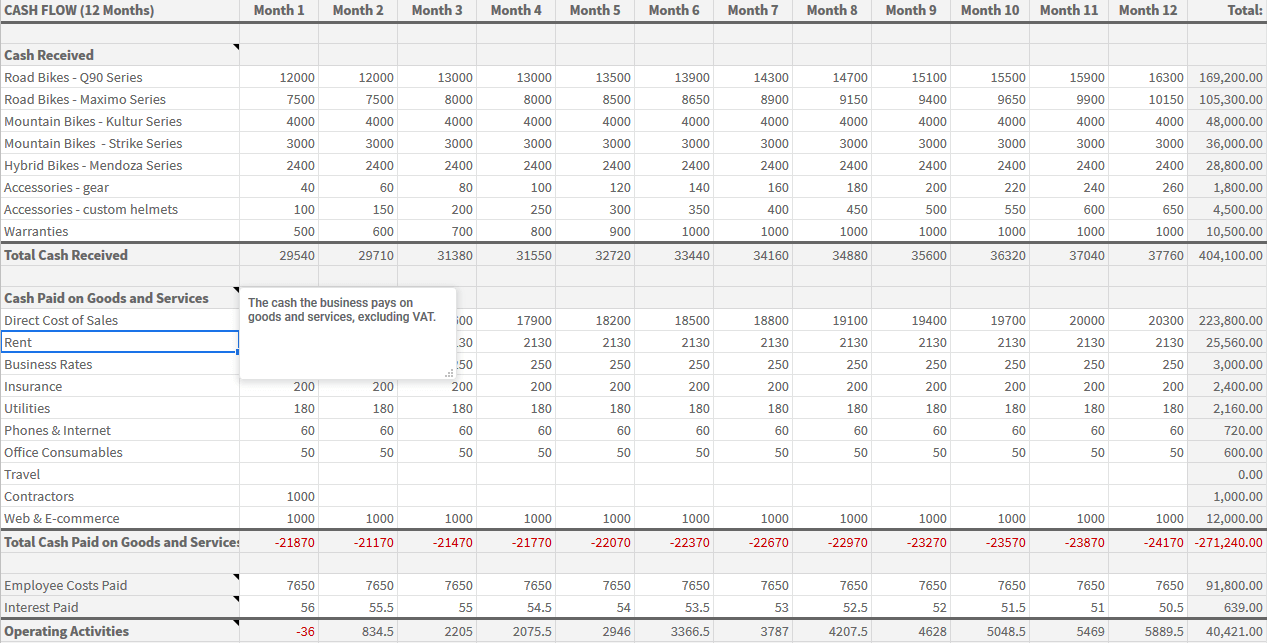

#FREE CASH FLOW FREE#

For example, Merck displays its investment in Idenix on its 2014 cash flow statement as “Acquisition of Idenix Pharmaceuticals, Inc., net of cash acquired.” Many users unwittingly ignore what is packed into that line item when computing free cash flow. What happens when a company acquires land, buildings, or other capital assets via a business combination? The cash flow statement presents all of the cash flows pertaining to the merger or acquisition in the cash flow from investing activities as one item. This also applies to assets that are depleted, amortized, or subject to impairment charges. Because free cash flow includes cash flows for capital assets-which are analogous to depreciation, as explained below-free cash flow is the better metric to employ when comparing and contrasting the entity’s earnings and cash flows. This, however, ignores the fact that depreciation charges and the concomitant gain or loss on disposition do in fact equal the firm’s cash flows with respect to the asset being depreciated. Cash flow from operating activities omits depreciation and similar charges, as these designate cost allocations rather than cash flows. Equity investors and short sellers also find free cash flows important when attempting to determine an entity’s valuation.įree cash flow is more comparable to net income than operating cash flows because net income includes a subtraction for depreciation charges. Creditors find this metric valuable when trying to evaluate a firm’s liquidity and solvency. An important variation of cash flow from operating activities is free cash flow, which is defined as cash flow from operating activities less capital expenditures. Perhaps the most important number on the cash flow statement is the cash flow from operating activities, also called operating cash flows or cash from operations. Cash flows, on the other hand, supply much-needed information about the liquidity and solvency of a corporation and act as an important adjunct for assessing earnings quality (Howard Schilit, Financial Shenanigans, 2nd ed.

The cash flow statement was a major improvement, as working capital flows are highly correlated with earnings and do not provide much information beyond the net income number.

Previously, business enterprises published a funds statement per APB Opinion 19, Reporting Changes in Financial Position, issued in 1971. Cash flow statements began appearing in corporate reports almost 30 years ago, after FASB issued Statement of Financial Accounting Standards (SFAS) 95, Statement of Cash Flows, in 1987.

0 kommentar(er)

0 kommentar(er)